영어/한국어 웹사이트

한국어? 위에서 선택

We are Nexcap Home Loans, an LA-based lender powered by a Korean team known for our exceptionally fast processing.

New Jersey (718)844-8608

Get a Home Mortgage Loan

Lower, Simpler, Faster, Easier, and Safer!

What we do

Some useful information

Order in buying a home

When buying a house, you need a lawyer, a real estate agent, and a mortgage loan officer.

Where to get a mortgage loan

Commercial banks, mortgage lenders, and mortgage brokers.

How much

Find out your maximum loan amount based on your salary, or the income required for your target loan.

Down payment amount, income, and especially FICO score! These are the key determinants!

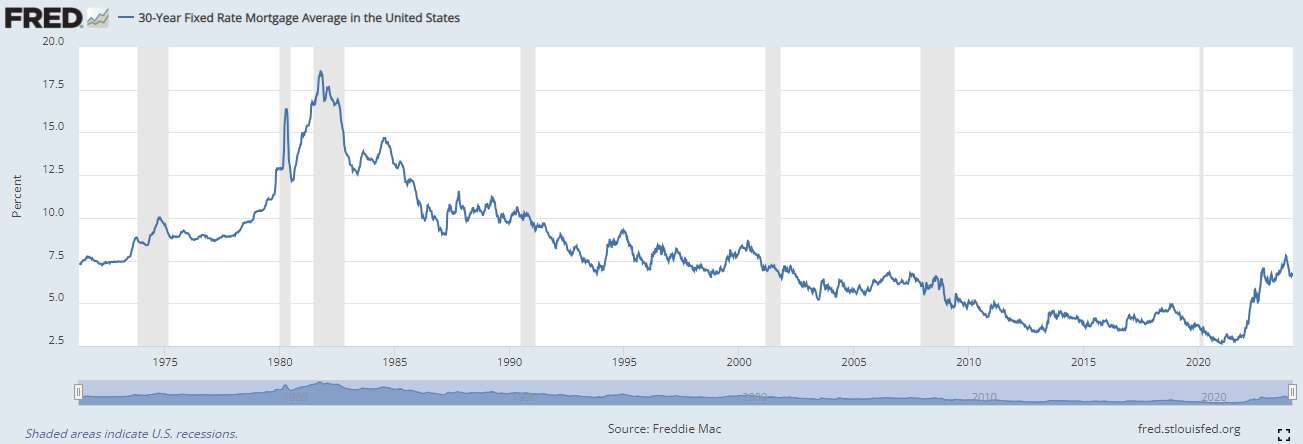

Mortgage interest rate trends over the past 30 years

15k+ clients worldwide use our products

About Mortgage Loans

Have SomeThat You Want to Share

FAQ

In general, the process of finding a house, signing a contract, and closing typically takes about two months, as it involves many steps and detailed work.

Our streamlined process delivers a pre-approval letter within just 20 minutes of a brief phone interview. Once all documents are submitted, we can close your loan in as little as 10 days.

If you encounter an unexpected situation, such as a SUDDEN INCREASE IN INTEREST RATES, WE MAY ASSIST YOU.

You can rely on us to help you secure the perfect home.

Our streamlined process delivers a pre-approval letter within just 20 minutes of a brief phone interview. Once all documents are submitted, we can close your loan in as little as 10 days.

If you encounter an unexpected situation, such as a SUDDEN INCREASE IN INTEREST RATES, WE MAY ASSIST YOU.

You can rely on us to help you secure the perfect home.

Various factors determine your interest rate, with the primary ones being your FICO score, down payment amount, and loan amount.

Essentially, we review your credit report, which reflects your financial history and creditworthiness. Once your credit profile is approved, we can provide you with suitable loan options.

A FICO score of 720 or higher is recommended. Below may result in higher rates.

A down payment of 30% or more is ideal. Lower amounts may increase your rate.

A loan amount of $300,000 or more is ideal. Smaller loan amounts may carry higher rates.

If rates drop even further as these figures improve? Unfortunately, that isn’t the case. These factors are the minimum requirements to avoid higher rates.

Please note that interest rates may be higher for second homes, condos, or investment properties.

Essentially, we review your credit report, which reflects your financial history and creditworthiness. Once your credit profile is approved, we can provide you with suitable loan options.

A FICO score of 720 or higher is recommended. Below may result in higher rates.

A down payment of 30% or more is ideal. Lower amounts may increase your rate.

A loan amount of $300,000 or more is ideal. Smaller loan amounts may carry higher rates.

If rates drop even further as these figures improve? Unfortunately, that isn’t the case. These factors are the minimum requirements to avoid higher rates.

Please note that interest rates may be higher for second homes, condos, or investment properties.

Nothing happens!

In the past, borrowers who paid off their loans earlier than the scheduled term faced prepayment penalties. However, these penalties have been eliminated in most loan programs today.

But of course, you must repay the remaining principal in full. So, whether it’s better to cut your losses early is something worth thinking about...

First of all, the loan is typically set for 30 years, with payments calculated equally over that period. However, during the early stages of the loan, you pay less toward the principal and more toward the interest. In other words, if you pay off the loan early on, you might find that you've mostly just paid interest while the principal remains largely untouched.

It's always a good thing to be debt-free, so if you have the money, it's probably best to just pay it off.

In the past, borrowers who paid off their loans earlier than the scheduled term faced prepayment penalties. However, these penalties have been eliminated in most loan programs today.

But of course, you must repay the remaining principal in full. So, whether it’s better to cut your losses early is something worth thinking about...

First of all, the loan is typically set for 30 years, with payments calculated equally over that period. However, during the early stages of the loan, you pay less toward the principal and more toward the interest. In other words, if you pay off the loan early on, you might find that you've mostly just paid interest while the principal remains largely untouched.

It's always a good thing to be debt-free, so if you have the money, it's probably best to just pay it off.

If you’re a first-time homebuyer in New Jersey, you may qualify for up to $15,000 in tax credits. Additionally, you could be eligible for up to $15,000 in down payment assistance, provided as a forgivable loan.

To qualify for these benefits, you must:

Work with an approved lender recognized by the State of New Jersey. Reside in the home you purchase as your primary residence for at least five years. Meet the income requirements, which vary by county and household size.

This assistance is typically available for full documentation loans, meaning you’ll need to verify your income through tax documents. However, it’s important to note that the interest rates for these programs may not be as competitive as those offered by other lenders, including us. If you’re interested in taking advantage of these first-time homebuyer benefits, we recommend checking the interest rates by contacting a participating lender. You can find the list of approved lenders on the New Jersey Housing and Mortgage Finance Agency (NJHMFA) website.

Please note that we do not offer this loan.

Click to view lender list.

To qualify for these benefits, you must:

Work with an approved lender recognized by the State of New Jersey. Reside in the home you purchase as your primary residence for at least five years. Meet the income requirements, which vary by county and household size.

This assistance is typically available for full documentation loans, meaning you’ll need to verify your income through tax documents. However, it’s important to note that the interest rates for these programs may not be as competitive as those offered by other lenders, including us. If you’re interested in taking advantage of these first-time homebuyer benefits, we recommend checking the interest rates by contacting a participating lender. You can find the list of approved lenders on the New Jersey Housing and Mortgage Finance Agency (NJHMFA) website.

Please note that we do not offer this loan.

Click to view lender list.

FHA loans are well-known for requiring a smaller down payment and providing various benefits.

However, in practice, these advantages may not always be as substantial as they appear. For example, FHA loans are only available as full-documentation loans, making them unsuitable for borrowers seeking no-documentation options. It’s also important to understand that a lower down payment often results in higher interest rates. Borrowers should thoroughly assess all aspects of an FHA loan, including the interest rates and mortgage insurance costs, to determine whether it aligns with their financial needs and goals.

In addition, if the down payment is less than 10%, you are required to pay for separate loan insurance throughout the repayment period. Even if the down payment exceeds 10%, you must still pay an upfront fee of 1.75%, and additional insurance costs until your ownership of the home reaches 20%.

However, in practice, these advantages may not always be as substantial as they appear. For example, FHA loans are only available as full-documentation loans, making them unsuitable for borrowers seeking no-documentation options. It’s also important to understand that a lower down payment often results in higher interest rates. Borrowers should thoroughly assess all aspects of an FHA loan, including the interest rates and mortgage insurance costs, to determine whether it aligns with their financial needs and goals.

In addition, if the down payment is less than 10%, you are required to pay for separate loan insurance throughout the repayment period. Even if the down payment exceeds 10%, you must still pay an upfront fee of 1.75%, and additional insurance costs until your ownership of the home reaches 20%.

Full Documentation Loan vs. Low or No Documentation Loan. What documentation is required? It depends on how you prove your income—specifically, whether you provide tax-related documents (Full Doc) or not (No Doc).

Full doc is Qualified Mortgage Loans (QM), No doc is Non Qualified Mortgage Loans (Non QM).

QM (Qualified Mortgage) refers to loans that are based solely on the income reported on your tax returns. NonQM (Non-Qualified Mortgage) refers to situations where tax returns are not considered, and income is verified through alternative methods.

The primary difference between the two is that NonQM loans generally come with interest rates that are about 1% higher than those of QM loans. For income verification in Non-QM loans, 12 or 24 months of bank statements, VOE (Verification of Employment), and a P&L (Profit & Loss) letter can be used.

Full doc is Qualified Mortgage Loans (QM), No doc is Non Qualified Mortgage Loans (Non QM).

QM (Qualified Mortgage) refers to loans that are based solely on the income reported on your tax returns. NonQM (Non-Qualified Mortgage) refers to situations where tax returns are not considered, and income is verified through alternative methods.

The primary difference between the two is that NonQM loans generally come with interest rates that are about 1% higher than those of QM loans. For income verification in Non-QM loans, 12 or 24 months of bank statements, VOE (Verification of Employment), and a P&L (Profit & Loss) letter can be used.

When taking out a mortgage loan, it’s always a good idea to consider the possibility of refinancing in the future.

Refinancing involves replacing your current mortgage with a new one. If interest rates decrease, refinancing allows you to lower your mortgage interest rate. The process is typically straightforward and doesn’t require a significant amount of time or money. Most of our clients who take out loans with us are offered refinancing free of charge.

There are three main types of refinancing:

Rate-and-term refinance: This option focuses on reducing your interest rate and/or adjusting the loan term to better suit your financial goals. Cash-out refinance: With this option, you can borrow additional funds against your home’s equity while refinancing your mortgage.

The cash-out refinance is often referred to as borrowing money using your home as collateral. It enables homeowners to access the equity they’ve accumulated in their property. It it called HELOAN.

Refinancing involves replacing your current mortgage with a new one. If interest rates decrease, refinancing allows you to lower your mortgage interest rate. The process is typically straightforward and doesn’t require a significant amount of time or money. Most of our clients who take out loans with us are offered refinancing free of charge.

There are three main types of refinancing:

Rate-and-term refinance: This option focuses on reducing your interest rate and/or adjusting the loan term to better suit your financial goals. Cash-out refinance: With this option, you can borrow additional funds against your home’s equity while refinancing your mortgage.

The cash-out refinance is often referred to as borrowing money using your home as collateral. It enables homeowners to access the equity they’ve accumulated in their property. It it called HELOAN.

The mortgage interest rate quoted during your initial conversation with a Mortgage Loan Officer (MLO) is not guaranteed to stay the same. Interest rates fluctuate daily based on market conditions.

The process of securing the current rate at a specific point in time is referred to as “locking in” or a “rate lock.” Typically, it’s advisable to lock in your rate 15 to 30 days before closing. Until then, monitoring market conditions is recommended.

In some instances, your lender might unexpectedly increase the interest rate at the time of locking in. If this happens, please don’t hesitate to reach out to me for assistance.

The process of securing the current rate at a specific point in time is referred to as “locking in” or a “rate lock.” Typically, it’s advisable to lock in your rate 15 to 30 days before closing. Until then, monitoring market conditions is recommended.

In some instances, your lender might unexpectedly increase the interest rate at the time of locking in. If this happens, please don’t hesitate to reach out to me for assistance.

Banks typically display the Annual Percentage Rate (APR) alongside interest rates. The APR reflects the cost of loan-related fees expressed as a percentage of the loan amount, in addition to the interest rate. The difference between the APR and the interest rate is often around 0.06% of the loan amount, though this can vary depending on the loan terms and associated fees.

You can ignore the APR because what truly matters is the interest rate.

You can ignore the APR because what truly matters is the interest rate.

Obtaining a loan is generally a straightforward process.

You simply need to verify your income and show that your bank account has sufficient funds.

The remaining documents are relatively easy to handle, with no complicated calculations or analyses involved.

You simply need to verify your income and show that your bank account has sufficient funds.

The remaining documents are relatively easy to handle, with no complicated calculations or analyses involved.

When the price of crude oil rises, the gasoline prices we pay every day increase almost immediately.

However, in the reverse situation, gasoline prices tend to decrease much more slowly. This behavior is similar to how adjustable rates function.

Additionally, many issues with loans often arise from ARMs (Adjustable Rate Mortgages), which is why these types of loans are becoming less common.

However, in the reverse situation, gasoline prices tend to decrease much more slowly. This behavior is similar to how adjustable rates function.

Additionally, many issues with loans often arise from ARMs (Adjustable Rate Mortgages), which is why these types of loans are becoming less common.

Home Mortgage Loan for purchasing a home

Refinance to reduce current mortgage interest rates

Cash Out Refinance for lowering interest rates while freeing up some additional funds

HELOAN to secure funds using your home as collateral

Commercial Loan solely for business purposes

We offer all these loans.

Refinance to reduce current mortgage interest rates

Cash Out Refinance for lowering interest rates while freeing up some additional funds

HELOAN to secure funds using your home as collateral

Commercial Loan solely for business purposes

We offer all these loans.

If you’re ready to buy a house and have the financial means, but can’t prove your income through your tax returns, there are still options available to you.

This situation is often addressed with Non-Qualified Mortgages (Non-QM) or No Documentation (No Doc) loans.

Non-QM loans are specifically designed for borrowers who don’t meet the standard criteria for traditional mortgages. These loans provide more flexible income verification methods, making them a suitable option for self-employed individuals, freelancers, or those with non-traditional income sources.

Alternative income documentation for Non-QM loans:

P&L letter addressed by a CPA

12 or 24 months of bank statements

Verification of Employment signed by the employer or HR.

DSCR, expected rental income from the home you are purchasing

This situation is often addressed with Non-Qualified Mortgages (Non-QM) or No Documentation (No Doc) loans.

Non-QM loans are specifically designed for borrowers who don’t meet the standard criteria for traditional mortgages. These loans provide more flexible income verification methods, making them a suitable option for self-employed individuals, freelancers, or those with non-traditional income sources.

Alternative income documentation for Non-QM loans:

P&L letter addressed by a CPA

12 or 24 months of bank statements

Verification of Employment signed by the employer or HR.

DSCR, expected rental income from the home you are purchasing

If you're already living in the US and wish to stay, you can purchase a home even without permanent residency or citizenship.

A minimum of two years of residency in the US.

Stable and predictable income.

Strong credit profile.

Sufficient credit lines or existing equity.

A minimum 20% down payment.

Evidence of financial stability for the next five years.

Proof of intent to reside in the US long-term.

A minimum of two years of residency in the US.

Stable and predictable income.

Strong credit profile.

Sufficient credit lines or existing equity.

A minimum 20% down payment.

Evidence of financial stability for the next five years.

Proof of intent to reside in the US long-term.

Balance (Gyunhyeong) Kim

T.(718)844-8608

NEXCAP HOME LOANS NEW JERSEY

333 SYLVAN AVE, #216

ENGLEWOOD CLIFFS, NJ 07632