You can disregard the section written in Korean below and go directly to the Closing Disclosure.

이 신문이 도대체 무슨 생각으로 얼마나 취재를 많이 하고 이런 기사를 썼을까…

이 신문의 내용을 보면 마치 내지 않아야 할 수수료를 엄청 내는 것 같은 느낌이 듭니다. 아마 이 기자가 집을 사는 프로세스를 한 번도 진행해 보지 않은 사람인 것 같습니다.

이 아래는 신문 내용입니다. 그리고 그 아래에 모기지 수수료가 도대체 얼마나 붙는지 이해를 돕기 위해 내가 처리했던 한 건의 Closing Disclosure 즉 수수료 총정리를 올립니다. 보통 클로징이란 계약을 시작해서 마지막 순간 사인하고 집 키를 넘겨 받는 것을 일컫습니다.

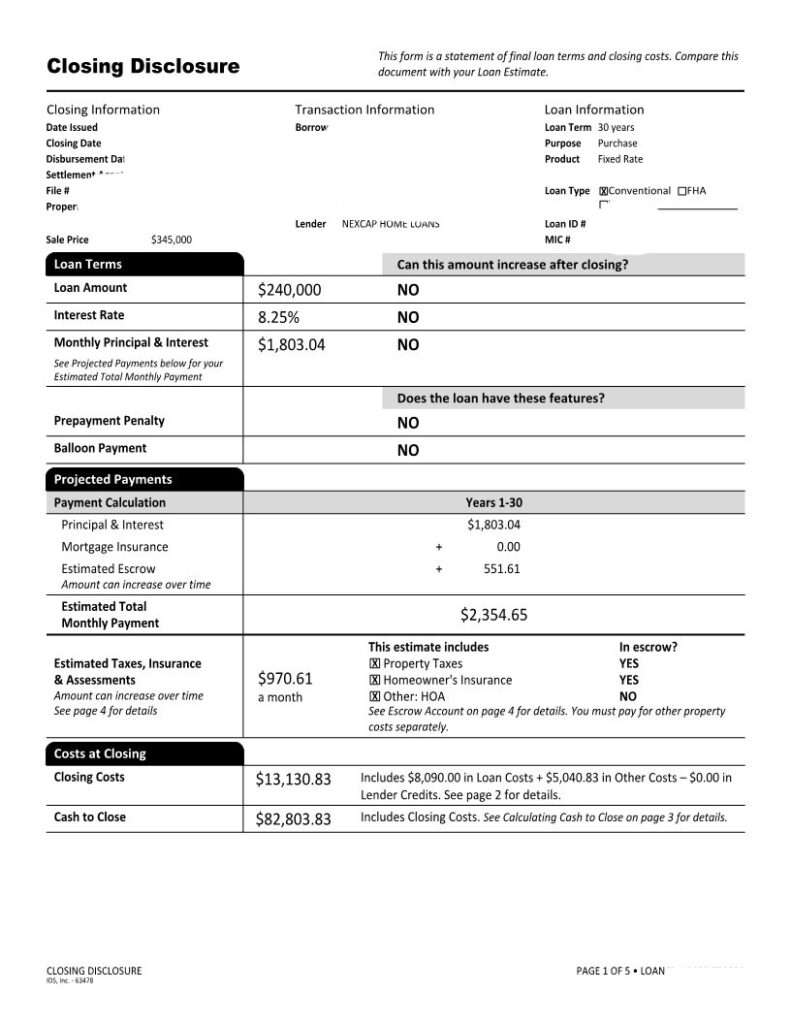

Closing Disclosure

You have a sample Closing Disclosure that shows how much you’ve already paid and how much you will pay at closing.

The first page shows who is buying a home from whom, the price of the home, the interest rate, the loan term, and the amount you will pay each month.

According to the documents, the buyer purchased a $345,000 home with a $105,000 down payment and obtained a $240,000 mortgage at a 30‑year fixed rate of 8.25% (this was when interest rates were at their peak). The monthly principal and interest payment is $1,803.04, and when you add $551.61 for taxes and homeowners insurance, the total monthly payment becomes $2,345.65. The $970.61 shown below indicates the HOA fee because this is a condo. In other words, $970.61 minus $551.61 equals $419, which is the HOA fee.

The Closing Costs of $13,130.83 at the bottom represent the total fees ($8,090 related to the loan and the rest for other expenses). The Cash to Close amount of $82,803.83 is the total amount you need to bring to the closing.

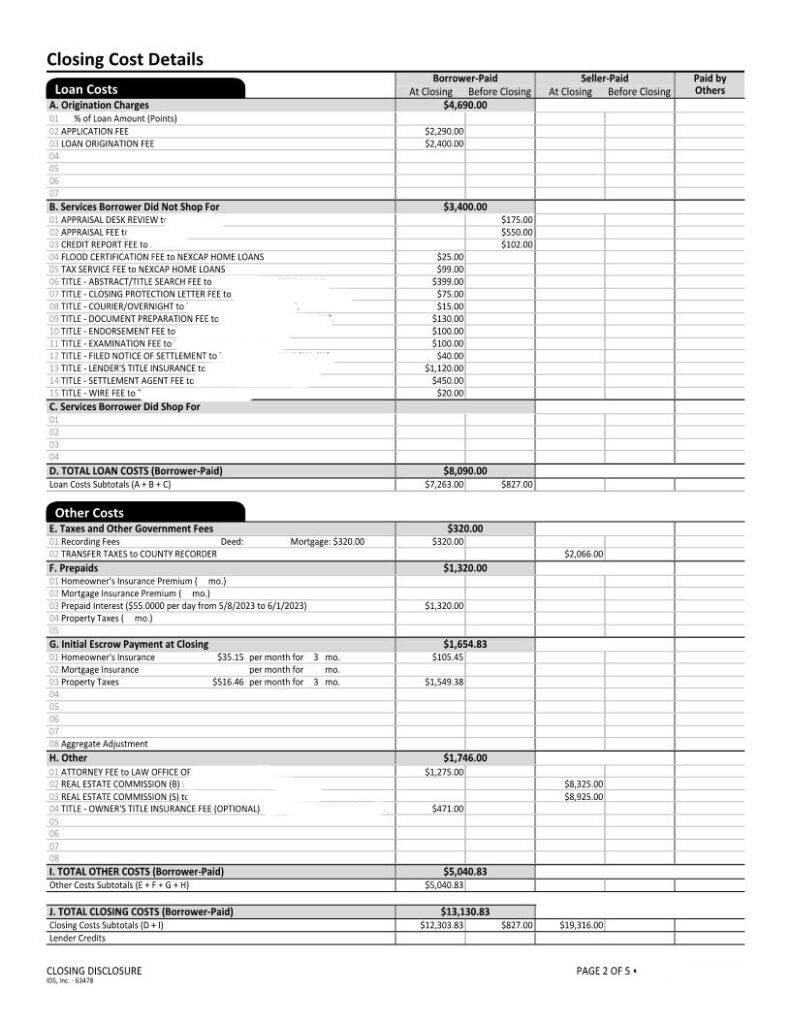

The second page shows a breakdown of how the amounts above were calculated. If you want to see the fees, this is the only page you need to look at.

Loan Costs refers to fees that are specifically related to the loan itself.

The first item, the Application Fee, is the fee you pay when applying for the loan. The Loan Origination Fee below it represents the points—in this case, one point. If you don’t want to pay this point, you don’t have to, but the interest rate will be about 0.25% higher. So if you remove this amount, the actual loan‑related fee is the $2,290 Application Fee.

The three items below are lender‑ordered services, meaning tasks we outsource to third‑party providers.

First is the home appraisal. We order this from an appraisal company, and they determine the value of the property.

The credit report fee is usually paid by us upfront or billed to you later.

These are the tasks the lender handles directly or orders from outside providers.

The items listed under ‘Title’ all relate to the legal aspects of the property. These are required for every home purchase. A title company—usually recommended by your attorney—handles these matters, and this company manages all explanations and documents at the final closing.

Below that, you will find the ‘Other Costs’ section.

E represents taxes, F is the prorated amount used to adjust the dates so the loan starts on the first day of the month (all mortgage loans are calculated from the first to the last day of the month). G covers insurance and taxes, and H includes attorney fees and other miscellaneous charges.

In conclusion, as you can see above, mortgage companies are not overcharging or adding junk fees. Every item is fully disclosed, and each one is explained at closing, so any attempt to overcharge would be immediately noticeable.

In the past, things like this did happen from time to time, and that eventually led to the 2008 crisis. Since then, a licensing system has been implemented and strict regulations have been put in place, so you no longer need to worry about being hit with excessive or unfair fees.