First of all,

High credit scores lower interest rates.

Reported taxable income can help lower interest rates.(Full doc)

Interest rates increase if the loan amount is less than 300,000.

If the loan amount is too small, an advance fee will usually be required.

Loans under $300,000 can result in a higher interest rate.

If the loan amount is too large (over $2 million), interest rates may increase, and fees may be required.

Most banks require an upfront fee. With us, paying points upfront can help you get a lower rate.

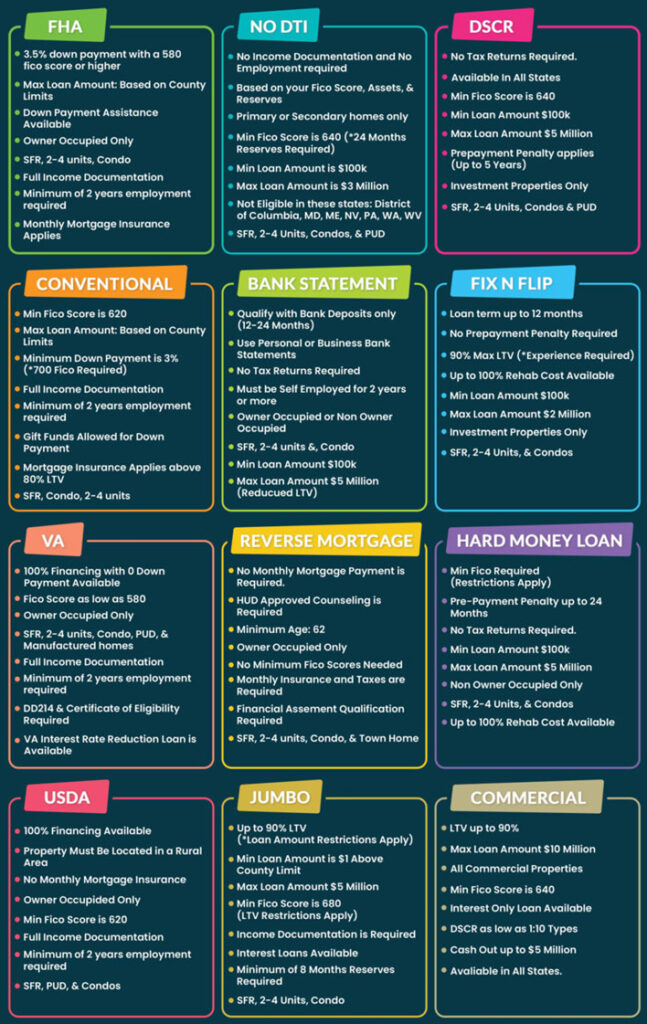

Types of Loan

Types of Loanare simple. Tax returns matter. Full or No.

If your income can be verified by tax reporting, it is called Full Doc; if not, No Doc. The difference between these two? Interest Rate! Full Doc has an interest rate around 1% lower than No Doc.

Tax returns (1040), W-2, and Pay Stubs will be required for Full doc.

For No doc, NO TAX DOCUMENT. You can talk with me.

Besides that,

There’s a difference depending on whether interest rates are fixed or variable, but now variable interest rates are almost gone and furthermore interest rates are not so low.

There are FHA and Conventional loans. FHA, standing for Federal Housing Administration, is backed by the government to ease lending by for example lowering FICO score, interest rates,and down payment by 3.5%.

And Interest only loans are also possible, but you need to download more than 40%. If it’s below that, interest rates can go up.

As an expert in the field,I recommend Conventional loan, because it is common and most beneficial in most cases.

And DON’T FORGET, ifyou got a loan when the interest rate is high, and the interest rates goes down later, you can lower the mortgage interest rate through Refinance (if the remaining period is too short, it’s meaningless, but in the opposite case, only 1% difference can be a lot meaningful.)

Refinancing can be a way to reduce your interest rate.

There are three;

Simply to lower the interest rates

Lowering interest rates and withdrawing more money.

Using your home’s equity without touching your primary rate.

If you are over 62 years old and have your own home,you have Reverse mortgage (We don't do this category.)

If you've been in the military, VA mortgagecan be a good option, which is only handled by participating lenders. We don’t handle it. Anyway, this is very good loan for those who qualify.

Interest rates- how decided?

Mortgage interest rates are applied differently to each person based on three main criteria: credit score, down payment amount, and loan amount.Additional factors can typically increase interest rates.

Generally, you receive a basic interest rate if: * Your credit score is 760 or higher * Your loan amount is $300,000 or higher * Your down payment is 30% or higher of the house price

If these criteria are lower, interest rates may increase.Interest rates also increase if the property is: * More than a two-family home * A condominium * An investment property

There’s a concept called POINTS. One point equals 1% of the loan amount. Points * 1 point can lower the interest rate by about 0.25% * The maximum number of points you can buy is 3points

Basically, we don't charge you upfront fees.

APR (Annual Percentage Rate) is another important concept. It includes: * The basic interest rate * All associated fees The APR is calculated by adding the total fees (expressed as a percentage of the loan amount) to the basic interest rate. It’s usually a few percentage points higher than the basic rate. The APR allows you to see the overall cost of the loan, including fees.