How much can I get?

## Please remember that these calculations apply to full-doc loans, where you are attempting to get a loan based only on the income you have reported on your tax returns. (You can generally consider about 3.5 times tax-reported income).A no-doc loan does not look at tax returns and may allow for a larger loan amount.

By knowing your annual salary, you can calculate how much loan amount you may qualify for.

(If you want to know how much you need to earn to buy a home of a certain price, click here.)

Use the following calculator when you know your annual salary.

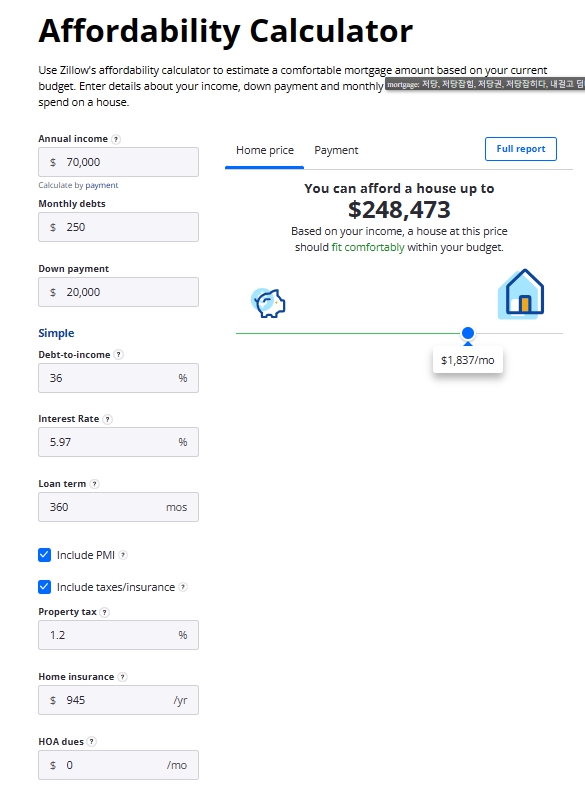

Affordability Calculator

Enter the description below.

Annual income – Enter your annual salary.

Monthly debts – Enter your current fixed monthly expenditure including minimum payment amount of credit cards, car loans, student loans, etc. Do not include rental and utility payments.

Down payment – Enter the down payment amount. It is recommended to be more than 30% of the house price. 20% is the minimum to avoid paying mortgage insurance.

Debt-to-income – Enter 40. DTI is the percentage of all debt including mortgage loans you expect to get.

Interest Rate – Check today’s interest rate on my website and enter it.

Loan Term – Enter 360 (for a 30-year loan.)

Include PMI – PMI is the mortgage insurance policy that must be paid when the down payment is under 20%. If the down payment exceeds 20%, you will not pay. Check as appropriate.

Include taxes/insurance – Make sure check this case as the mortgage payment calculation includes tax and home insurance.

Property tax is different for each township. And it is complicated to calculate, so just leave it as default.

Home insurance – Ask any insurance agent and enter the amount.

HOA dues – These are monthly maintenance fees for condominiums. Enter the amount if you buy a condo and know the amount. Ask your real estate agent if unsure.