How much money I need to earn to buy a home of a certain price?

To calculate how much salary you need to earn to buy a house, use the following.

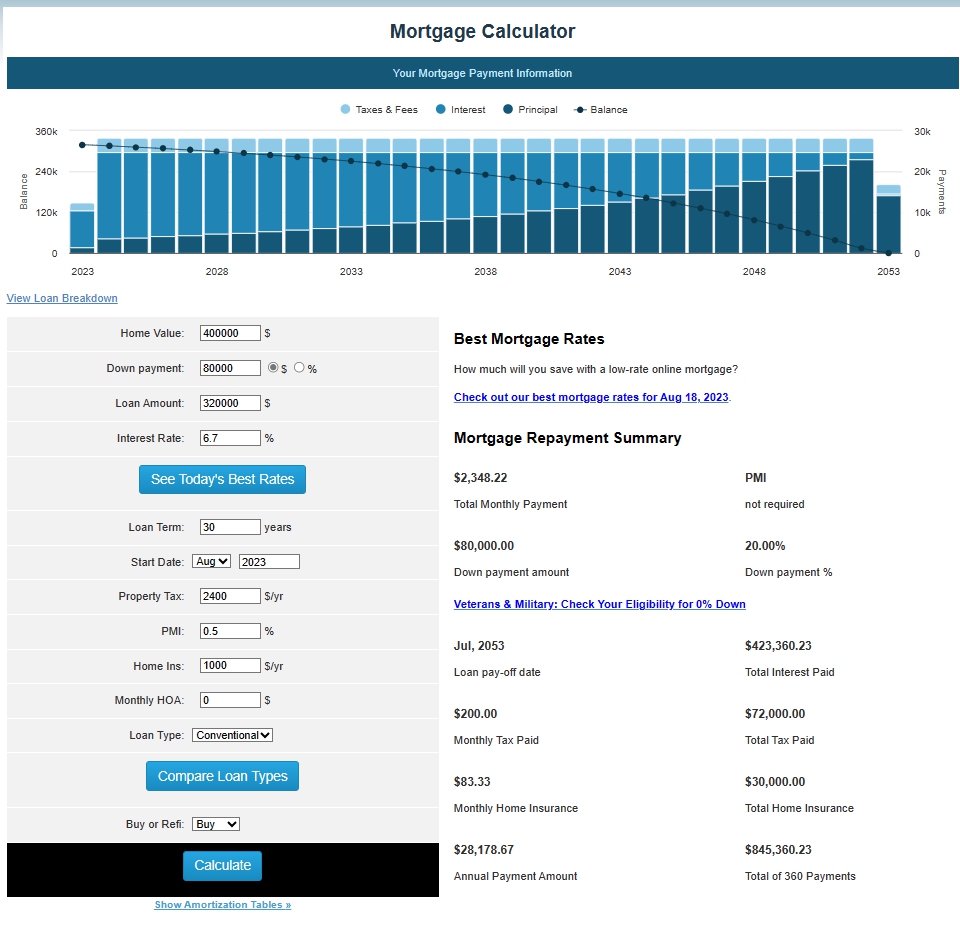

First, calculate monthly payments with the mortgage calculator below.

Mortgage Calculator

Home value – Enter the house price.

Down payment – Enter the amount of the down payment.

Loan amount – Automatically calculated.

Interest rate – Enter the interest rate of the day from my website.

Loan term – Typically 30 years.

Start date – Leave it as default.

Property tax – Enter the one-year tax amount of the house you are purchasing. Ask your real estate agent.

PMI – If your down payment is 20% or more of the house price, enter 0. If less than 20%, enter 1 (PMI typically ranges between 0.5% and 1.5% of the loan amount. PMI is Private Mortgage Insurance that the borrower must pay when the down payment is less than 20%).

Home ins – Enter the amount of one-year insurance of the house.

Monthly HOA – Enter monthly maintenance fees for the condominium or 0 for the house. Or, for more accurate results, enter your all debt amounts including auto loans, student loans… etc.

Loan Type – There are four Loan types, Conventional, FHA, VA, and USDA. Generally Conventional.

Buy or Refi – Choose Buy if you buy, Refi for Refinance.

When every item is filled in, click calculate. You will get the amount you have to pay back each month.

Now, calculate how much you need to earn based on the amount you obtained.

Remember that the DTI ratio is 40%, meaning the monthly amount calculated above should not exceed 40% of your income.

Divide the monthly payment by 40%, that is 0.4. The amount shown in the image above is $2348.22 and divided by 0.4, it becomes $5870.55.

This means that your monthly income must be at least $5870.55.

Multiply this by 12 to determine annual income to afford the home sample above. $5870.55*12=$70,446.6 must be your minimum annual income.